Deciding what is right for you

Things to think about.

- How much you have saved? Include savings with other providers to get the whole picture before making any decisions. Don’t forget to include your State Pension. You can find out how much this will be here.

- Will your outgoings change during retirement? Perhaps you will need more income when you first retire than later in retirement.

- Is being certain about your income important to you?

- Can you take some risk with part or all of your savings to improve your overall income? If you leave your funds invested, they may go up in value – but remember they can go down as well as up.

- Inflation means that the value of any savings held in cash will go down over time.

- The Government provides free guidance through Pension Wise at retirement so that you understand your options and can choose which one is right for you.

Useful tips

- You will usually be able to take part of your fund tax free, usually 25%, whichever option you choose

- Your income will depend on the amount you have saved

- If you have benefits from a final salary scheme, it is usually better to take those as a pension from that scheme

- Taking benefits early nearly always means you get less

- If you buy a secure income, you can’t usually change your mind

- You can transfer your benefits to other providers with different options and charges

- The Money Advice Service provides helpful information

- The risk of pension scams is high when you are thinking about your retirement. Don’t let a scammer enjoy your pension. Find out more here.

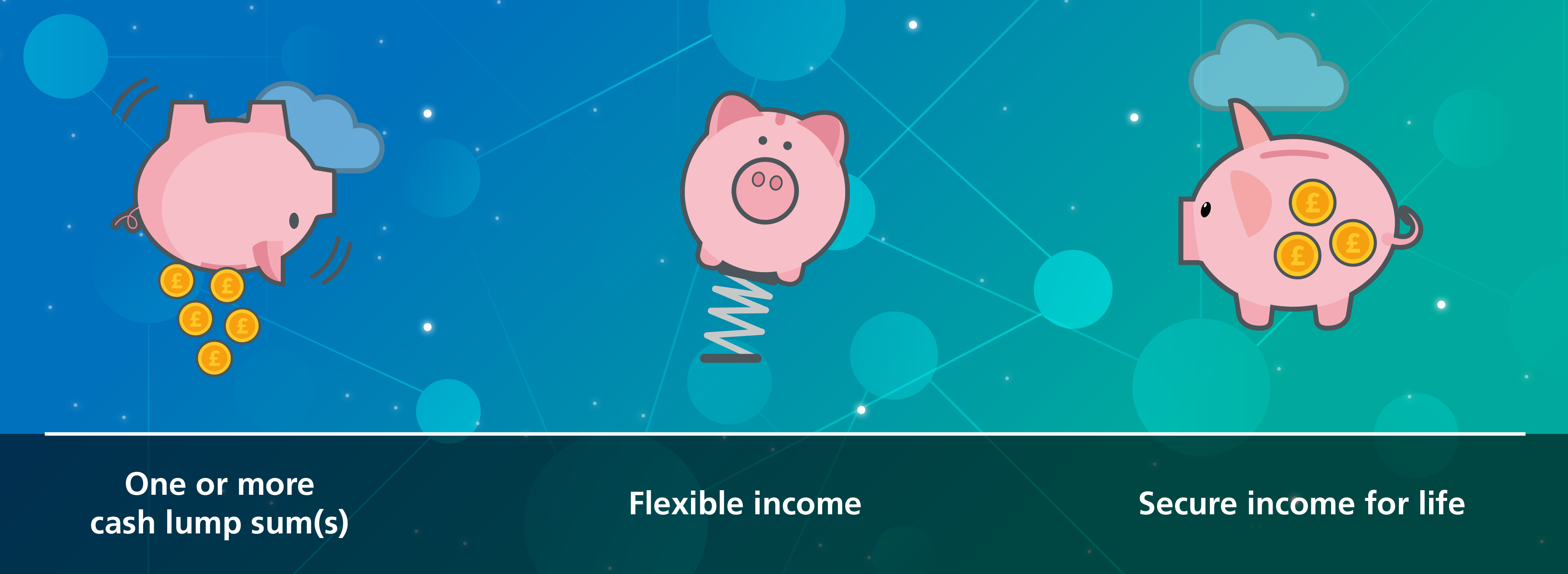

You have three main options

Read our factsheets for more information

Retirement factsheet 1 - Your options

Retirement factsheet 2 - Cash

Retirement factsheet 3 - Flexible income

Retirement factsheet 4 - Secure income

Retirement factsheet 5 - Making your decision

Investment is important too

The Trustees can look after your savings in the Cheviot Lifeplan but as you start to think about accessing your savings, you need to think about how they are invested. Cheviot offers a range of retirement investment strategies to help you, which are explained in

Investment Factsheet 3.